APPENDIX D

45 • Isle of Man Financial Services Authority Annual Report 2016/17

DI STR IBUT ION OF LOCALLY INCORPORATED

BANKS BY R I SK ASSET RAT IO

The capital adequacy of Isle of Man incorporated banks is measured on a risk-weighted basis

in accordance with Basel II international standards. The higher the ratio, the greater is the level

of capital adequacy relative to risk rated assets. The statutory minimum risk asset ratio is 8%

and the Authority can agree a higher minimum ratio on an individual bank basis. All Isle of Man

incorporated banks are required to notify the Authority if their actual risk asset ratio falls, or is

expected to fall, within at least 1% of their minimum ratio. All banks have a notification level of

10% or above.

The Authority is implementing new minimum capital adequacy standards from 1 July 2017,

based on the Basel III framework; this will require all Isle of Man incorporated banks to hold a

minimum total ratio of at least 10% (with a notification level of 11% or above) and a minimum

common equity tier 1 ratio of at least 8.5%.

At the end of March 2017 all Isle of Man incorporated banks held more than the minimum risk

asset ratio.

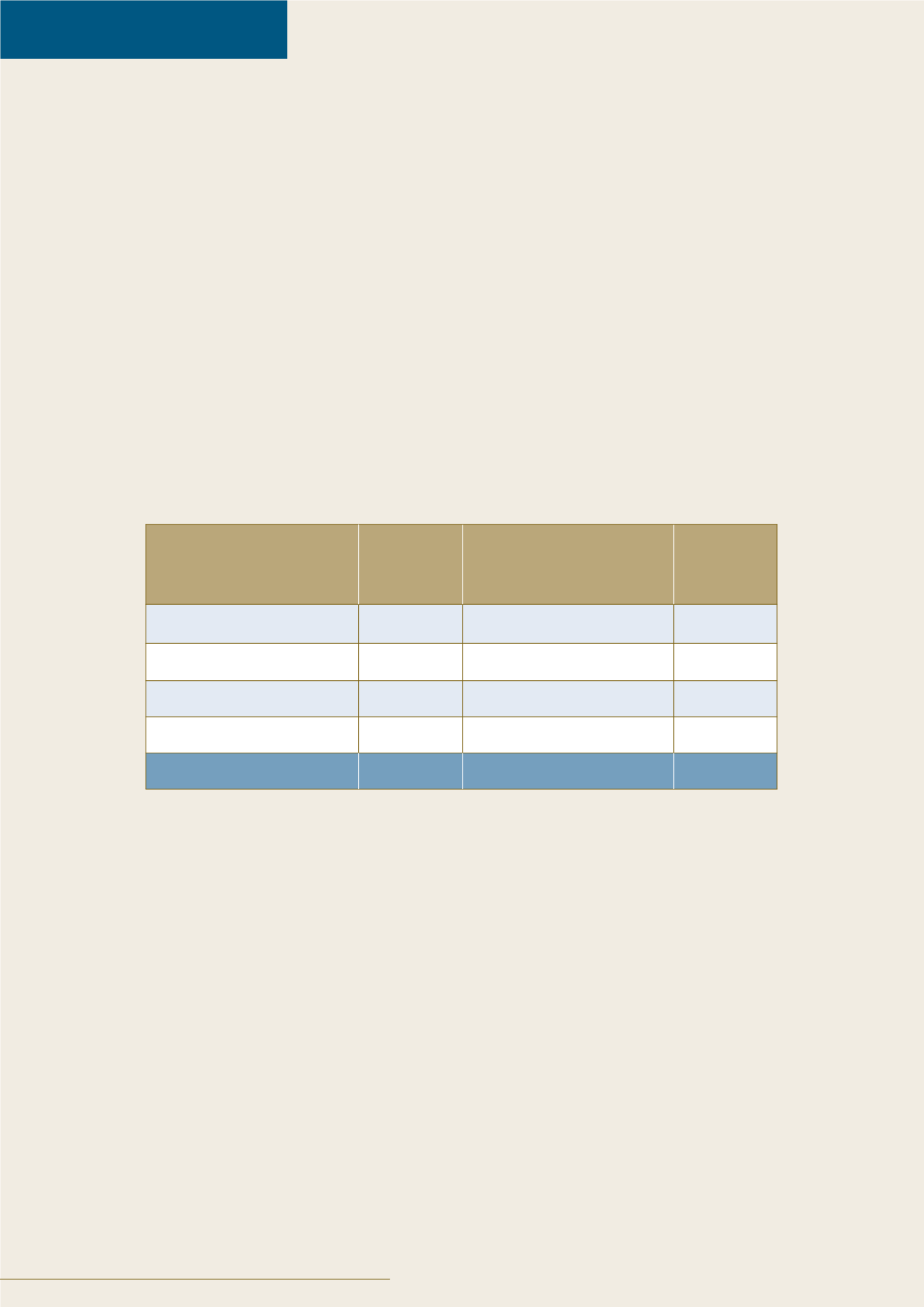

Minimum prescribed risk

asset ratio

Number

of locally

incorporated

banks

Actual risk asset ratio

Number

of locally

incorporated

banks

Less than 10%

2

Less than 10%

0

From 10% to less than 15% 6

From 10% to less than 15% 2

From 15% to less than 20% 0

From 15% to less than 20% 3

20% and over

0

20% and over

3

Total

8

Total

8