APPENDIX E

2. Fee Income and Civil Penalties

Fee income comprises annual, application and pro-rata fee income in relation to Deposit

Taking, Investment Business, Services to Collective Investment Schemes, Corporate

Services, Trust Services, E-money and Money Transmission Services, Collective Investment

Schemes, Authorised Insurers, Insurance Permit Holders, Insurance Managers, Insurance

Intermediaries and Pensions Scheme Administrators along with registration fees and

annual fees from DNFBPs .

From 2016/17 income from civil penalties levied on regulated entities, is shown separately

from fee income. This change has been made to differentiate between these different

types of income.

3. Other Income

Other Income includes £113,525 in legal expenses paid by the Authority on behalf of an

Isle of Man based fund requiring external oversight, but which is illiquid. The costs were

recharged to the fund. As the expectation is that the fund has no assets, the amount was

written off at the end of the period. (See notes 6 and 8.)

4. Salaries

Included within salaries are employer pension contributions of £454,406. With effect from

1st April 2016, Executive Government Pension costs were re-allocated to Departments.

The Authority was awarded a budget of £511,139.

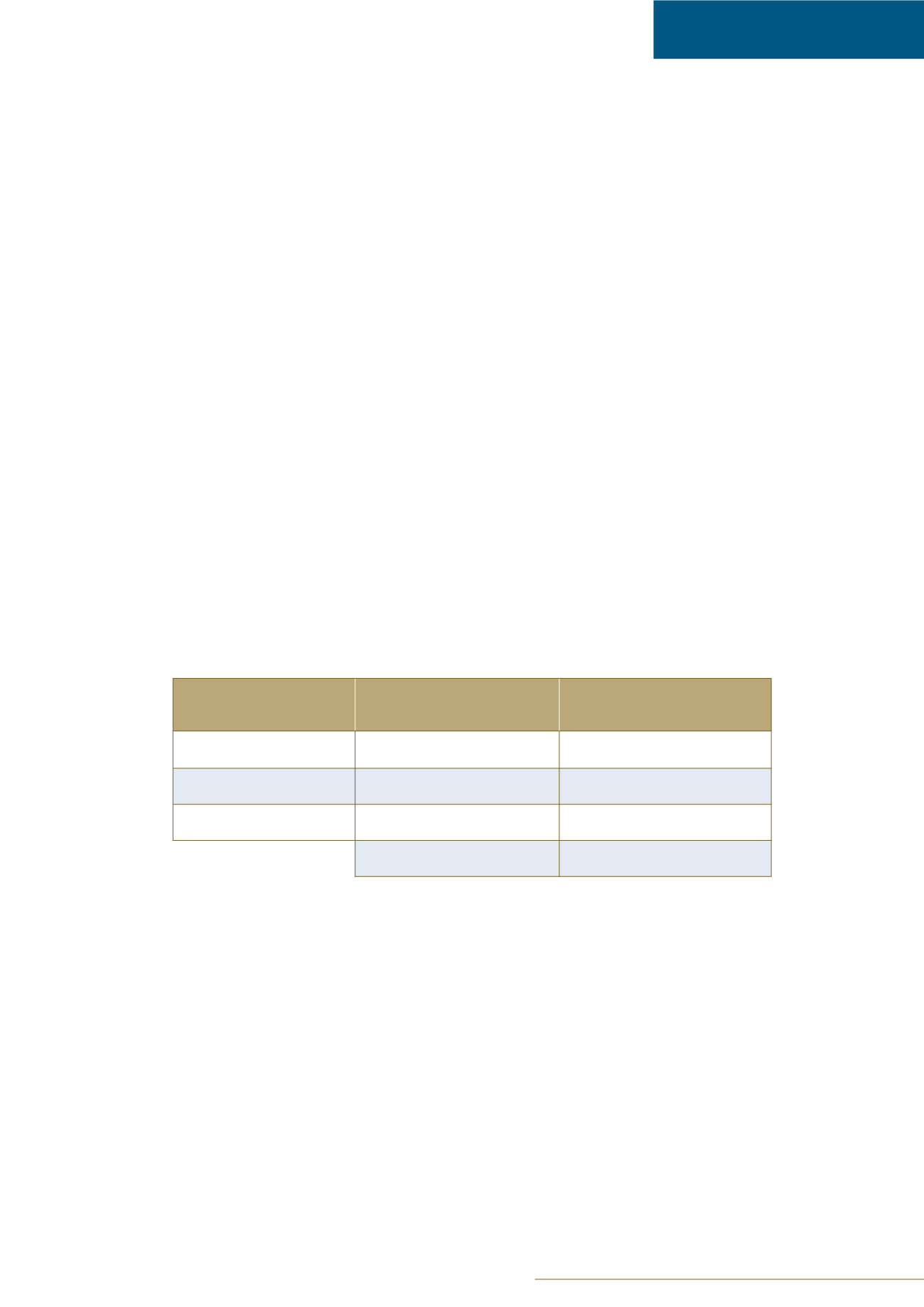

Annual remuneration of the employees of the Authority is payable within the

following bands:

The 76 members of staff equate to a full time equivalent of 68 employees.

5. Members’ Remuneration

Membership of the Authority is reduced compared to the combined membership of the

predecessor organisations of the Insurance and Pensions Authority and the Financial

Supervision Commission. In addition, one Member left during the year and it was

decided that it was not necessary to appoint a replacement.

6. Professional Fees and External Consultancy

The Authority has experienced a significant number of cases requiring external legal

advice which is reflected in the level of expenditure in this area.

In addition, expenditure includes professional fees of £113,525 paid by the Authority on

behalf of an Isle of Man based fund, requiring external oversight, but which is illiquid. The

costs were recharged to the fund, but subsequently written-off (notes 3 and 8).

At 31 March 2017

Total number of employees

At 31 March 2016

Total number of employees

£0 - £99,999

71

70

£100,000 - £199,999

4

3

£200,000 - £300,000

1

1

76

74

Isle of Man Financial Services Authority Annual Report 2016/17 • 57