An open and transparent approach

A commitment to openness and transparency continues to underpin the work of the Isle of Man Financial Services Authority. It also has a part to play in maintaining the Island’s reputation as a well-regulated, responsible and forward-looking jurisdiction.

Our aim is to provide stakeholders with clear, consistent and honest communications in respect of our performance and future plans. We engage with firms in various formats to highlight key developments, to explain our expectations for compliance, and to seek industry input into emerging areas of focus via consultations and surveys.

Publications such as our Annual Report and Strategic Plan provide an overview of the Authority’s priorities and direction of travel, while we regularly publish statistics to summarise the size and level of activity within the various financial sectors.

In addition, the enhancement of our capabilities in respect of data gathering and analytics will enable us to publish a range of Key Performance Indicators (KPIs). These statistics are intended to provide further transparency around our performance, including against service level agreements where applicable.

The Authority will continue to add to the information below in the time ahead in order to demonstrate performance across different functions.

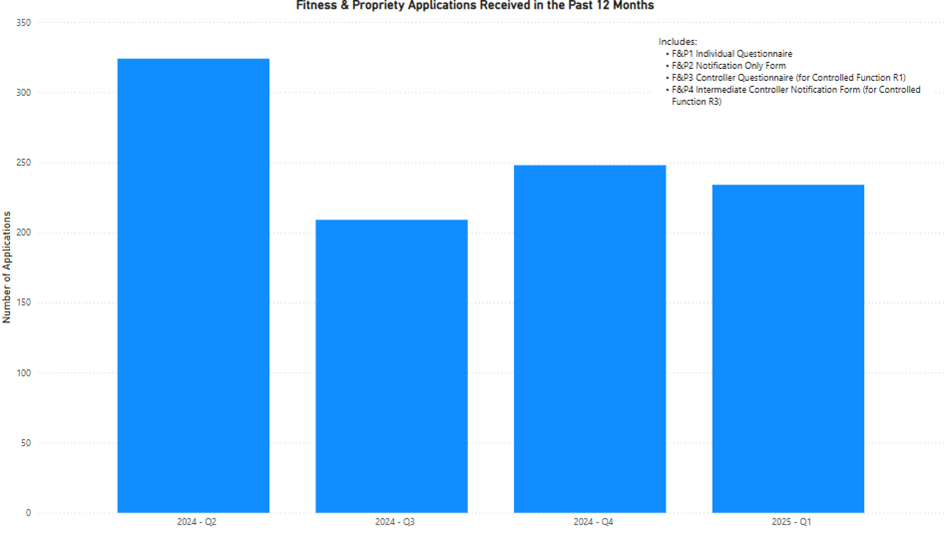

Fitness and propriety (F&P) applications play an important role in the work that takes place to achieve our regulatory objectives.

The term F&P applications includes the following:

- F&P1 Individual Questionnaire (notified and accepted Controlled Functions)

- F&P2 Notification Only Form (notified only Controlled Functions)

- F&P3 Controller Questionnaire (for Controlled Function R1) (a notified and accepted Controlled Function)

- F&P4 Intermediate Controller Notification Form (for Controlled Function R3) (a notified and potentially accepted Controlled Function)

F&P applications help to assess whether an individual is suitable to perform a controlled or senior management function. As explained in our regulatory guidance on fitness and propriety: “As well as the regulated entity, the Authority also considers an individual’s fitness and propriety. In doing so it relies on the due diligence of the regulated entity in relation to all Controlled Functions. Additionally, for those that are notified and accepted Controlled Functions (or in other cases should this be considered necessary) the Authority will also undertake due diligence of its own, such as communication with other regulators.”

The bar chart titled ‘Fitness and Propriety Applications received in the past 12 months’ highlights the number of F&P applications assessed over the 12 months to the end of Q1 2025.

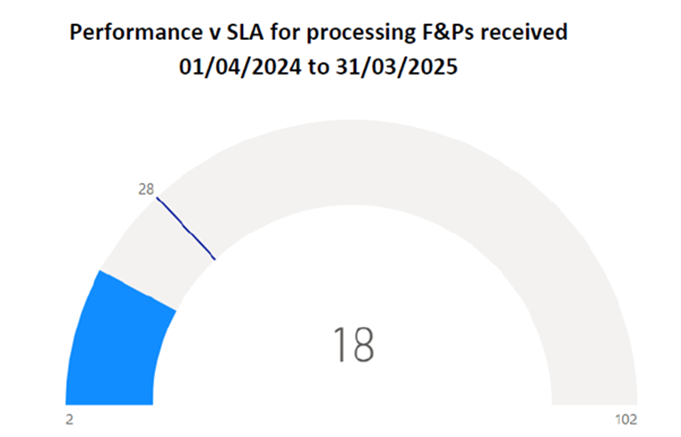

The semi-circle pie chart titled ‘Performance v SLA for processing F&Ps received 01/04/2024 to 31/03/2025’ reflects an average of 18 days to process a notified and accepted Controlled Function against the Service Level Agreement (SLA) of 28 days. Notified and accepted Controlled Function assessments continue to be processed well within the SLA.

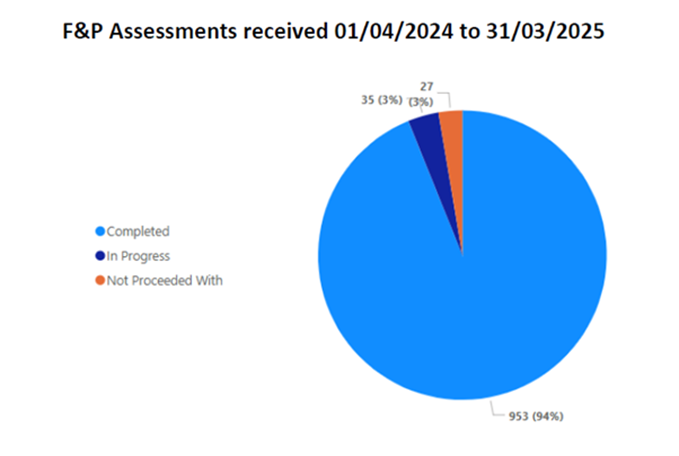

Note that in the pie chart titled ‘F&P Assessments received 01/04/2024 to 31/03/2025’, applications shown as “not proceeded with” include F&P applications that are withdrawn before/after a determination is made as to the individual’s fitness and propriety.

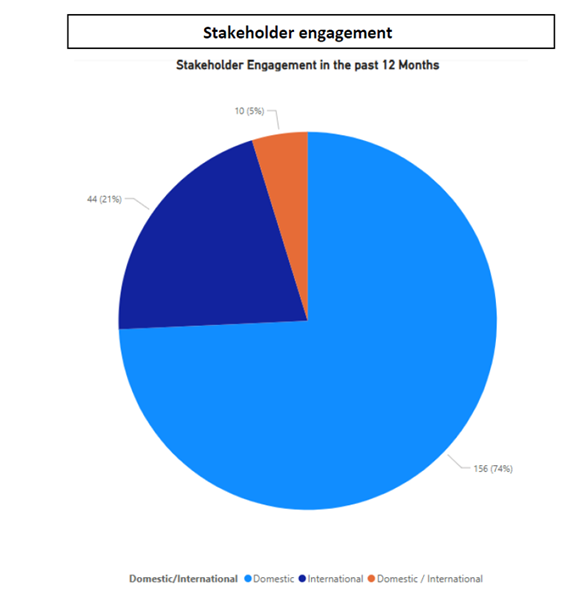

Effective outreach and engagement are crucial in developing established channels of communication with both our domestic and international stakeholders, keeping them up to date and informed of our plans. It also assists in fostering trust and co-operation. This can lead to better regulatory outcomes, including greater confidence in the Island’s financial service sector, protection of consumers and international collaboration.

Our work with stakeholders allows for the collection of diverse perspectives and expertise, encouraging innovation, and provides greater opportunity to respond to new developments and emerging risks in an agile manner. On an international level, it helps in establishing and promoting effective implementation of international standards and helps raise awareness of the Island’s track record of international compliance.

The graphic below highlights the number of engagement activities the Authority has been involved in over the 12 months to the end of Q1 2025.

Outreach and engagement activities include:

- Regular news releases and stakeholder bulletins

- Speaking events at industry conferences and attendance at workshops

- Industry presentations (some which are available to re-watch on our website as part of a webinar series)

- AML awareness campaigns on social media, covering different topics each week

- Publishing an ‘at-a-glance’ timetable for 2025/26, with a snapshot of forthcoming data requests, thematic reviews, inspections, events, consultations, and reports

- Partnering with the Isle of Man University College to support the delivery of training and education in business administration, compliance, and anti-money laundering

- Collaborating with the AICP on organising a series of workshops on relevant topics, providing practical support and guidance

- Participation in the Finance Forum, Innovation Challenge, Insurtech and Innovation Hub and other cross agency initiatives

- Meeting with other regulators including through regulatory colleges

- Attendance at forums of international standard setters

- Supporting Isle of Man Government delegations at UK, European and international events

- Participation in the 2025 programme of the Small Countries Financial Management Centre

The Authority is committed to maintaining the integrity and resilience of the financial sector. Conducting inspections (desk-based, or onsite) forms a vital part of this commitment.

Inspections, including our thematic work, form part of a suite of supervisory tools that assist us in assessing the risks that firms or sectors pose to the Authority’s regulatory objectives. In addition, they provide an opportunity for firms to demonstrate compliance with the relevant legislation, with both the Authority and firms being open and co-operative to achieve the right outcomes.

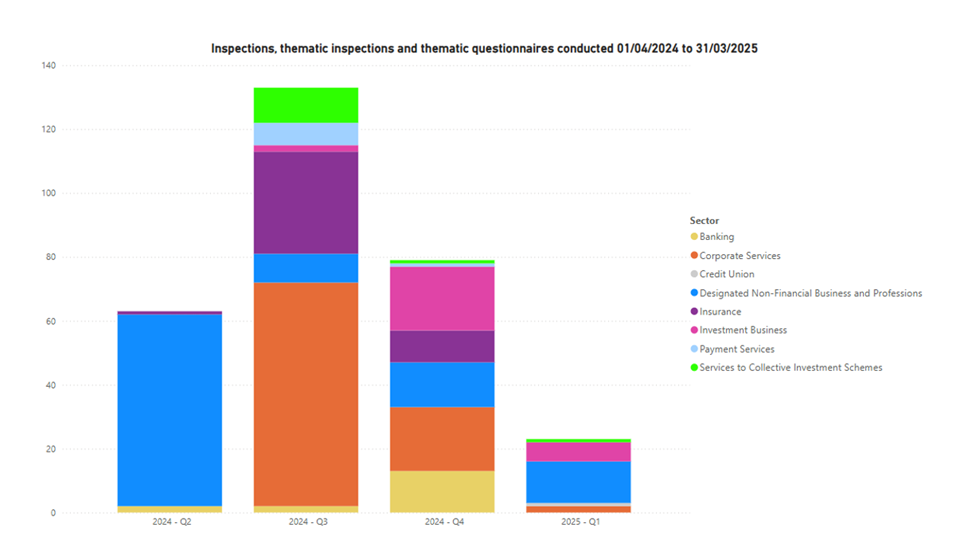

The bar chart titled ‘Inspections, thematic inspections and thematic questionnaires conducted 01/04/2024 to 31/03/2025’ highlights the number of inspections, thematic inspections and thematic questionnaires carried out by the Authority over the course of 12 months to the end of Q1 2025 (excluding Beneficial Ownership entity inspections which are detailed separately further below).

The key provided alongside the bar chart titled ‘Inspections, thematic inspections and thematic questionnaires conducted 01/04/2024 to 31/03/2025’ further details the types of firms and sectors inspected during the 12-month period.

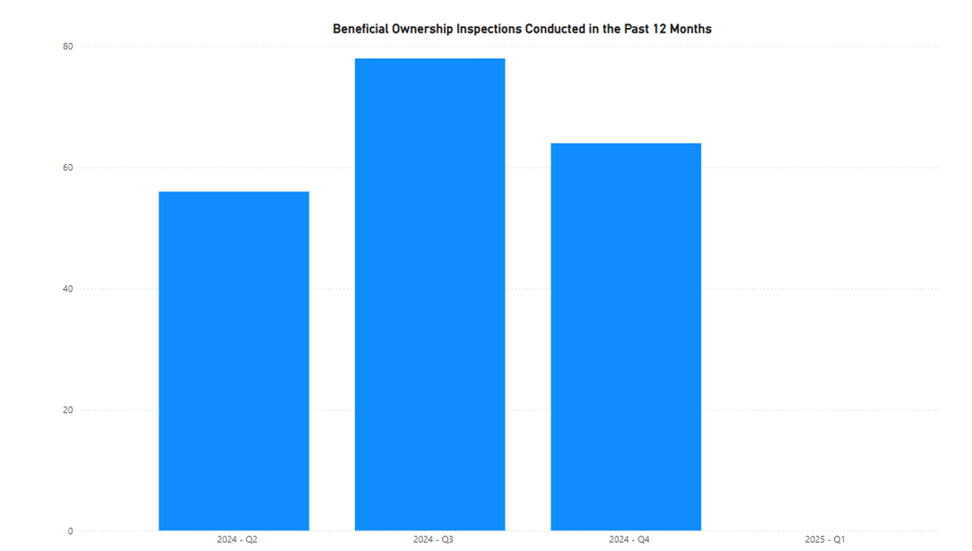

The bar chart titled ‘Beneficial Ownership inspections conducted in the past 12 months’ reflects the entities inspected over the 12 months to the end of Q1 2025.